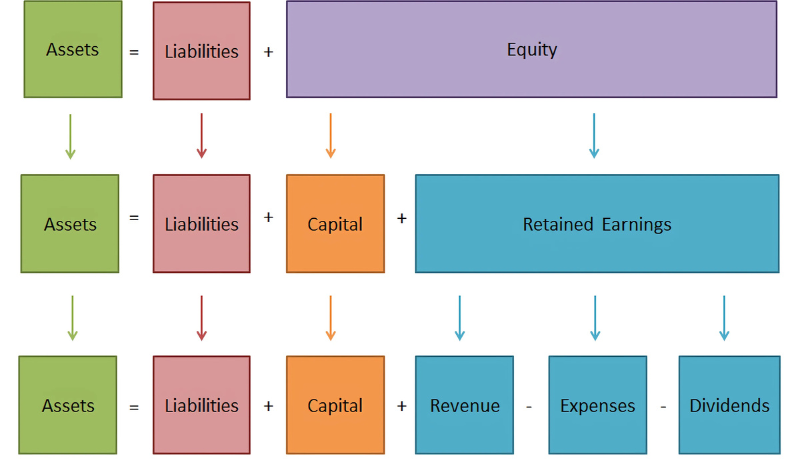

Assets = Liabilities Owners Equity

The utilization of accounting equations to calculate liabilities and owner’s equity.

Liabilities = Assets – Equity

Equity = Assets – Liabilities

An extended form of the accounting equation.

Assets = Liabilities + Owner’s Equity + Revenue – Expenses – Drawings.

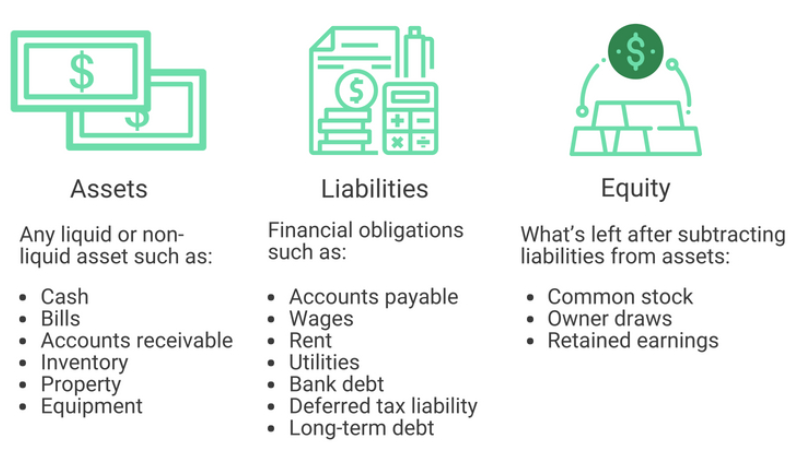

The financial position of a business is a representation of these three fundamental components. It is also called the “Basic Accounting Equation”. A company’s Balance Sheet depends upon these three main components. That’s why this equation is also known as the “Balance Sheet Equation”.

Assets represent the valuable resources controlled by the company, the liabilities represent the obligations of that company. The liabilities and shareholders’ equity represent a picture of how the assets of a company are financed. If it is financed through debt, it’ll show as a liability or an obligation on the company, and if it’s financed through issuing equity shares to investors, it’ll show in shareholders’ equity.

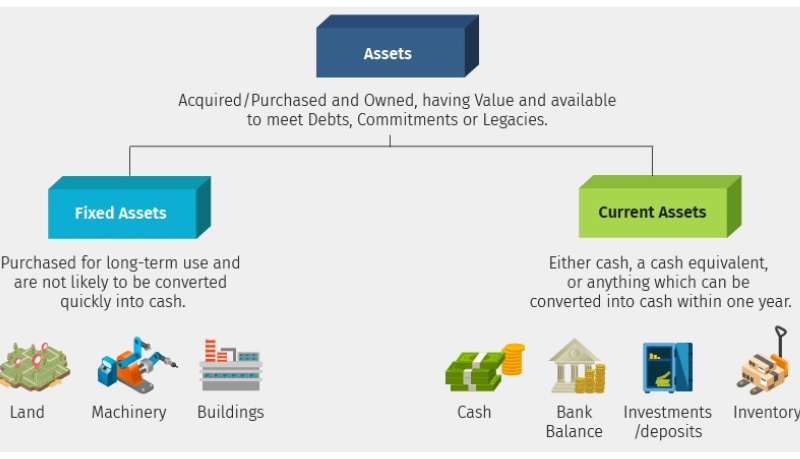

Types of assets

There are two types of assets:

- Current assets

- Fixed assets

Current assets

Current assets include Cash, Account Receivables A/R,

Inventory, Company’s Bank Deposite, and Inventory, and anything which is convertible into cash within one year.

Fixed assets

Fixed assets include land, building, and machinery and purchased for long-term use and are not likely to be converted into cash quickly.

Types of liabilities

Liability is a legal obligation of an individual or a business entity towards creditors arising out of some transactions.

Types of liabilities

There are three types of liabilities:

- Current liabilities

- Long term liabilities

- Contingent liabilities

Current liabilities

Current liabilities are those which are due or liable within one year.

Examples of current liabilities:

- Accounts payable

- Interest payable

- Income taxes payable

- Bills payable

- Bank account overdrafts

- Accrued expenses

- Short-term loans

Long term liabilities

Long-term liabilities are those which don’t come immediately but become due after one year.

Examples of long term liabilities:

- Bonds payable

- Long-term notes payable

- Deferred tax liabilities

- Mortgage payable

- Capital leases

Contingent liabilities

Contingent liabilities are those liabilities payable on the occurrence of an event or contingency.

Examples of Contingent liabilities:

- Lawsuits

- Product warranties

Owner’s equity

There are four in the equity section:

- Capital

- Revenues

- Expenses

- Drawings

The capital in the ledger of the owner’s equity generally shows the investment of the owner.

The other three accounts revenues, expenses, and the drawing show the changes in the owner’s equity from one time period to the next.

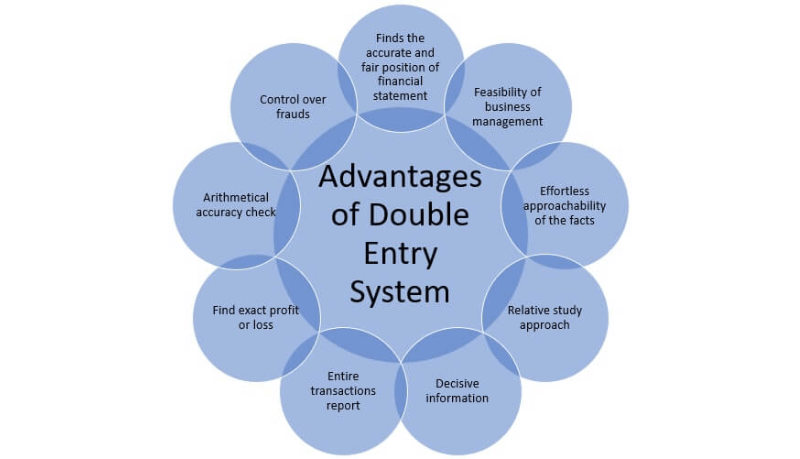

The double entry system

The double entry system operates based on the relation between the components of the accounting equation. The double entry is done based on its effects on the other side of the equation, so any entry is not a single solitary one, it carries an effect on both sides of the Balance Sheet. By the operation of the double-entry system, the accounting equation ensures that the balance sheet remains “balanced,” and each entry made on the debit side should have a corresponding entry (or coverage) on the credit side of the equation.

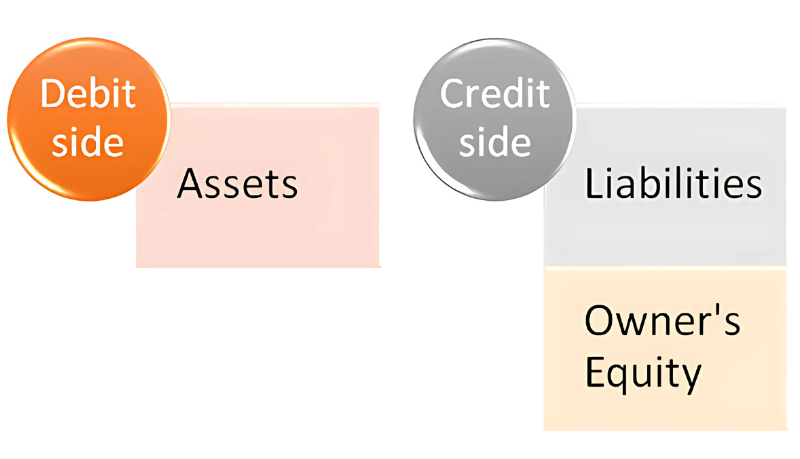

The two sides of the equation

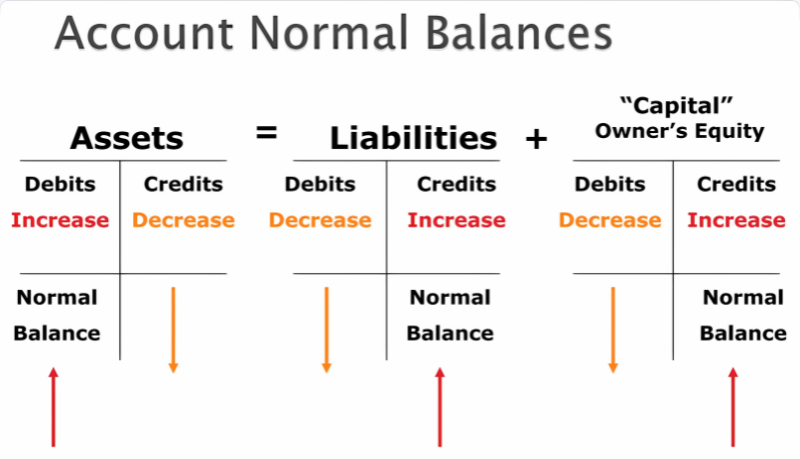

The Debit Side The left side of the equation is the debit side. As you can see, the left side of the equation consists of Assets. When a company generates assets its effect would be debited from the equation.

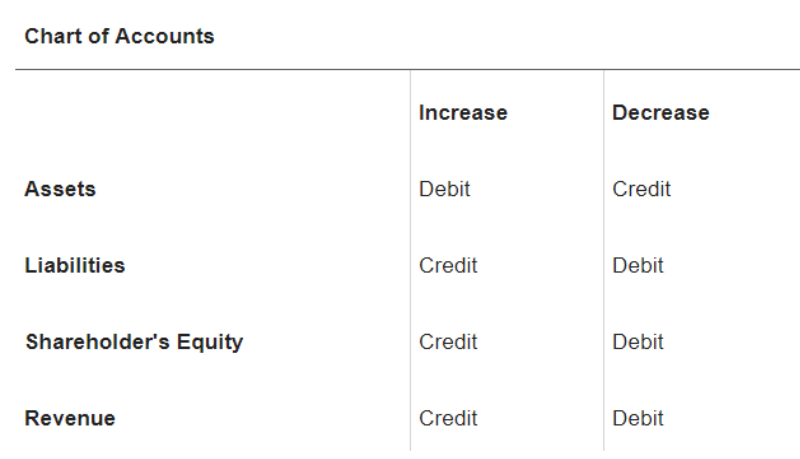

Debit entries for various accounts:

- Increase in assets

- Increase in expense

- Decrease in liability

- Decrease in equity

- Decrease in income

The Credit Side The right side of the equation is the credit side. The right side of the equation consists of Liabilities and Owner’s Equity. The company ledger is credited when there would be liability generated in the account or a change in the owner’s equity.

Credit entries and their effect on various accounts:

- Decrease in assets

- Decrease in expense

- Increase in liability

- Increase in equity

- Increase in income

A common effect of entries in the chart of account

How it all works

Consider an organization “XYZ, Inc” that started business with an investment of Rs-5 million. The owner investment should have a credit effect on the equity side and a debit effect on the asset side of the accounting equation.

Now, Next the owner had to purchase a computer system and printer for XYZ, Inc. of Rs-500000 The following is the journal transaction:

Both accounts are asset accounts. So, you credited your cash account and debited your equipment account. If you then sold the same system for Rs-500000, you would credit your equipment account and debit your cash account. While this may not sound correct, your chart of accounts tells you that an equipment account decreases with a credit and a cash account increases with a debit.

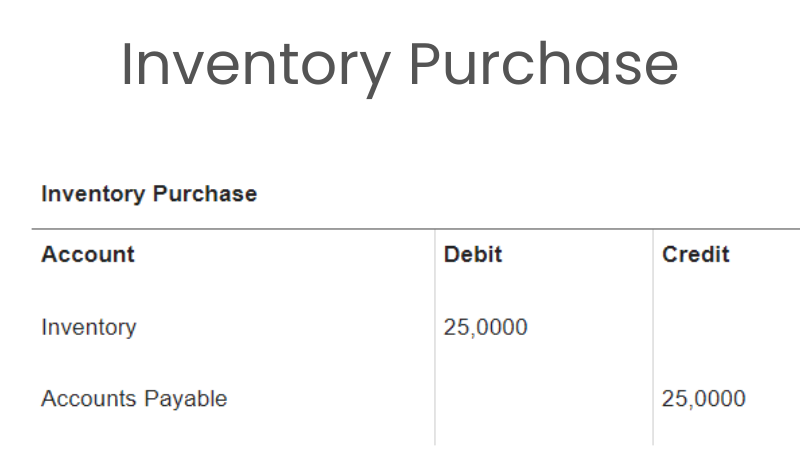

The owner purchased Rs-25,0000 in inventory on account. The inventory account would be debited for Rs-25,0000 and accounts payable would be credited for Rs-25,0000. The journal entry would look like this:

These are a few examples of common journal entries for a typical small business.